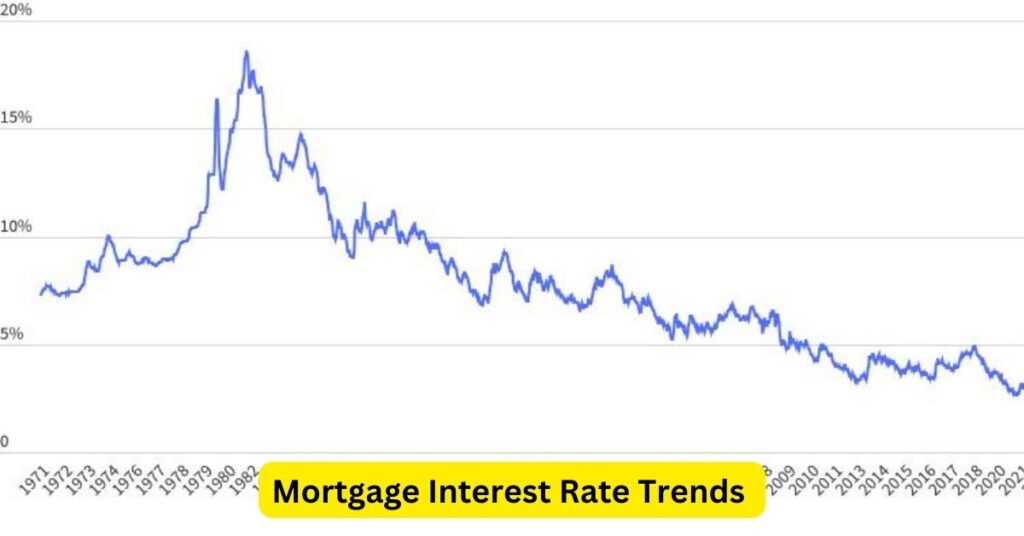

Mortgage Interest Rate Trends: Historical Analysis

Mortgage interest rates play a pivotal role in the real estate market, influencing homebuyers’ decisions and the overall health of the housing sector. Understanding the historical trends of mortgage interest rates can provide valuable insights for both homebuyers and investors. In this article, we’ll analyze the historical trends of mortgage interest rates to shed light […]

Mortgage Interest Rate Trends: Historical Analysis Read More »